Although The Clergy Assurance Fund traces its official history back to its Charter in 1769, its roots are much deeper. As early as 1715, Archbishop of Canterbury Thomas Tenison left a substantial sum in his estate for the benefit of missionaries of the Church of England that were serving under the Society for the Propagation of the Gospel in Foreign Parts and who found themselves in financial or physical distress. Although this bequest made no provision for the widows and orphaned children of these missionary clergy, it carried into foreign lands such as the American colonies the concerns of the even older organization, the Corporation for the Sons of Clergy, founded in 1655.

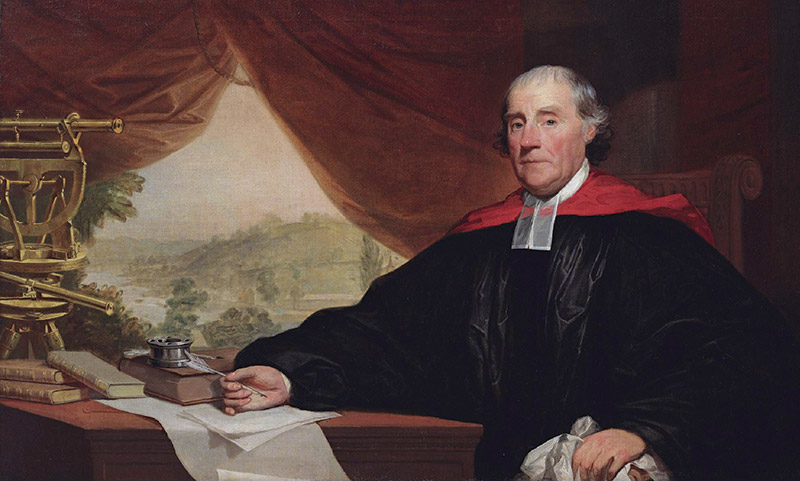

Thus, when The Reverend Dr. William Smith, Provost of the College of Philadelphia (later the University of Pennsylvania), traveled to England and Scotland in the early 1760’s and became familiar with the newly established London Annuity Society, formed in 1761 specifically to care for the widows and orphans of Church of England clergy, it was not surprising that he would bring news of the development back to his clergy friends in Philadelphia. After several preliminary meetings of clergy, a committee of six clergymen from New York, New Jersey, and Pennsylvania, including The Reverend Richard Peters, Rector of Christ Church, Philadelphia, was appointed to petition the Governors of the three colonies for permission to form a benevolent society for this purpose. So it was that February 7, 1769, Governor John Penn of Pennsylvania granted the original Charter and what became known as The Widows Corporation was officially formed.

Originally the Corporation encompassed all three colonies, and funds were solicited from clergy and laypersons not only in America, but also in Barbados and back in London, where The Right Reverend Richard Terrick, Bishop of London, made personal contributions to the growing fund. The first meeting of the Corporation was in October 1769 at Christ Church, Philadelphia, and was attended by thirty nine Members including Chief Justice Benjamin Chew of Pennsylvania, Chief Justice Frederick Smythe of New Jersey, The Reverend Dr. Myles Cooper, President of King’s College, New York and of course Dr. Smith who delivered the inaugural sermon. Perhaps due to the quality of preaching, a “very generous” offering equivalent to $140 was made at the church doors for the benefit of the new organization. As the Corporation began to set about its work, the Corporation consulted with Benjamin Franklin “the great economist and calculator” to develop the scheme by which annuities would be paid. This was done in spite of the fact that Dr. Smith, who had been elected first President of the Corporation, reportedly held Franklin in great “disteem” and had charged him in 1762 with “want of the truth and with malignant tempers.” Perhaps because of this estrangement, Dr. Franklin was represented at meetings of the Corporation by his close associate, Joseph Galloway, Speaker of the Assembly of Pennsylvania.

The Corporation proceeded to go about its work, soliciting funds and enrolling clergy, and it soon began to support the widows of those clergy who died while engaged in mission work in the colonies until the tempestuous days of the American Revolution. Since the Church of England had sent these missionaries, the Anglican Church in the colonies was understandably torn asunder by the animosities engendered at this time, and many clergy left to return to England. When the war ended in the early 1780’s it took some time for affairs in the remaining church to settle down. When the Corporation was able to convene its next Annual Meeting in 1784, fully two-thirds of the Members last present at a meeting (in 1775) were gone, either back to England or to eternal rest. Therefore the Corporation elected twenty-nine new members, including Alexander Hamilton, Robert Livingston and John Jay of New York; Robert and Gouverneur Morris of Pennsylvania; and John Rutherford (nephew of the Earl of Stirling) and Joshua Maddox Wallace (later a founder of the American Bible Society) of New Jersey.

An examination of the accounts of the three new states’ treasuries showed that Pennsylvania held about £2,800 and New York held £1,237. However, with what was referred to as his “retirement beyond the seas” the Treasurer for New Jersey had taken all but £18 with him back to England. The Fund therefore totaled about $10,800 at the end of the American Revolution.

Another outcome of the 1784 meeting was that correspondence begun the previous year between The Reverend Abraham Beach of New Brunswick and The Reverend Dr. William White of Philadelphia blossomed into the formation of a committee to apply to the Archbishop of Canterbury and the Bishop of London for permission to form “a continental representation of the Episcopal Church and for the better management of the concerns of the said Church.” This process inexorably led to the formation in 1789 of what is now The Episcopal Church, of which new Bishop William White became the first Presiding Bishop.

In 1796 it was decided that three separate state societies should be formed and the funds divided amongst them. It took almost ten years to accomplish this, but in 1806 the fund, now totaling almost $26,500 was divided, with Pennsylvania receiving $10,390.

In 1835, The Honorable Horace Binney, later to become President of the Corporation, suggested that the period for contributing to the annuity fund be limited to fifteen years, after which a clergy family would be considered fully vested and receive full benefits. This payment period has remained a constant factor ever since that decision … over 180 years!

Both the New York and New Jersey societies continued the original financial model whereby annuities were paid to surviving widows and orphans. In the 1830’s, however, again on Mr. Binney’s wise recommendation, the Pennsylvania society changed to its present model by which highly subsidized policies of life insurance have become the principal means of support to clergy families, even though grants of financial assistance to widows and children are still made on an annual basis. The financial wisdom of this decision can be seen in that, in a survey in 1933, while the respective funds of the other state societies were New York – $500,000 and New Jersey – $200,000, the Pennsylvania society’s fund had grown to $2,000,000.

By 1869, the program now known as Premium Refunds was instituted. After fifteen years of payments for insurance, policies were declared “Paid Up” and when excess earnings permitted, dividends were paid to the policyholders. While this program has never been guaranteed, it has remained in place even in times when earnings were low due to adverse conditions in the financial markets.

In 1909, the Fund surpassed the one million dollar mark for the first time, and need-based grants to surviving widows and orphans totaled about $5,000. This proportion, about one-half of one percent of the total fund, has continued to this day, but it is complemented by additional grants to insured clergy families through the Wellness Fund.

Throughout the first half of the 20th Century, enrollment in the programs of the Corporation hovered around three hundred clergy. In the mid-1950’s a serious effort was made to expand coverage throughout Pennsylvania and by the end of the century over a thousand clergy families were under the protective umbrella of the Corporation.

Although it has been said that “The Corporation moves at a stately pace,” the 21st century history belies that characterization:

In the first decades of the Corporation, the President was the equivalent of a Chief Executive Officer; in later years the President simply presided at the Annual Meeting of the Corporation and Chairman of the Acting Committee became the more significant officer, charged with managing the Committee that met monthly and made investment and other policy decisions that were then carried out by the Treasurer and his staff. Regardless of title, The Clergy Assurance Fund by whatever name has been extremely fortunate to have a long and distinguished series of volunteer Presidents below:

Though in recent decades not permitted to be a Member of the Corporation, the Treasurer of The Clergy Assurance Fund is actually the person who is most directly responsible for the work of the organization. Essentially the executive director, the Treasurer reports to the Acting Committee on issues of policy, but manages the affairs of the Corporation on a day-to-day basis, presently assisted by a program officer called the Chaplain. Throughout the years, the Corporation has benefited from the dedicated leadership of its fifteen Treasurers: